Why Europe needs a strong domestic fertilizer industry

Fertilizers – a vital industry for Europe

Fertilizers enable 50% of food production, contributing to food security in Europe and beyond. In doing so, the industry is essential in providing European consumers with nutritious, affordable, and sustainable food, supporting the objectives of the EU Farm to Fork strategy.

Furthermore, the fertilizer industry produces about 40% of the total of European hydrogen as raw material of ammonia production. It is therefore also uniquely placed to contribute to the objectives of the EU Green Deal and the development of a green hydrogen economy in Europe.

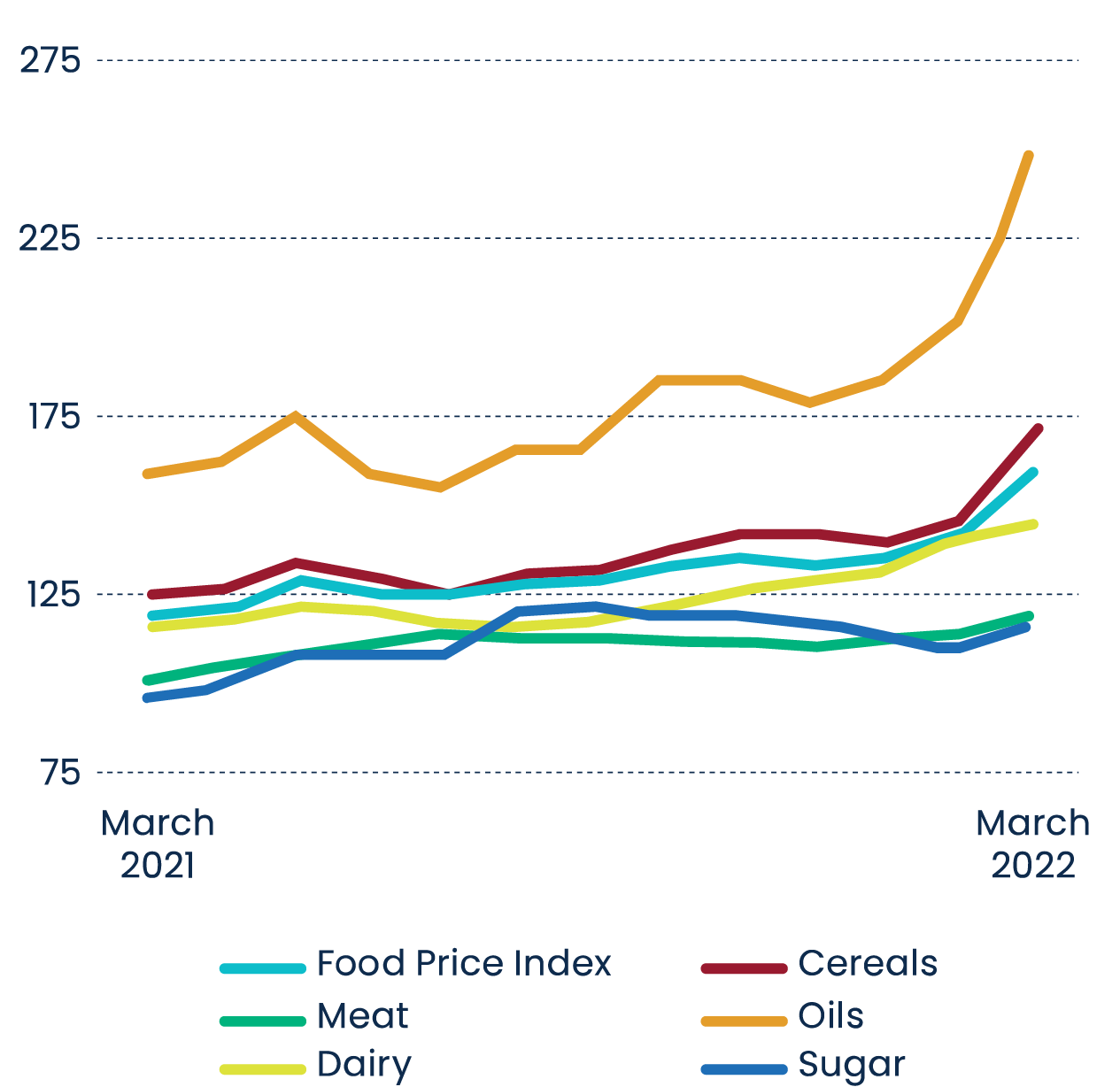

EU Fertilizer industry’s competitiveness challenged

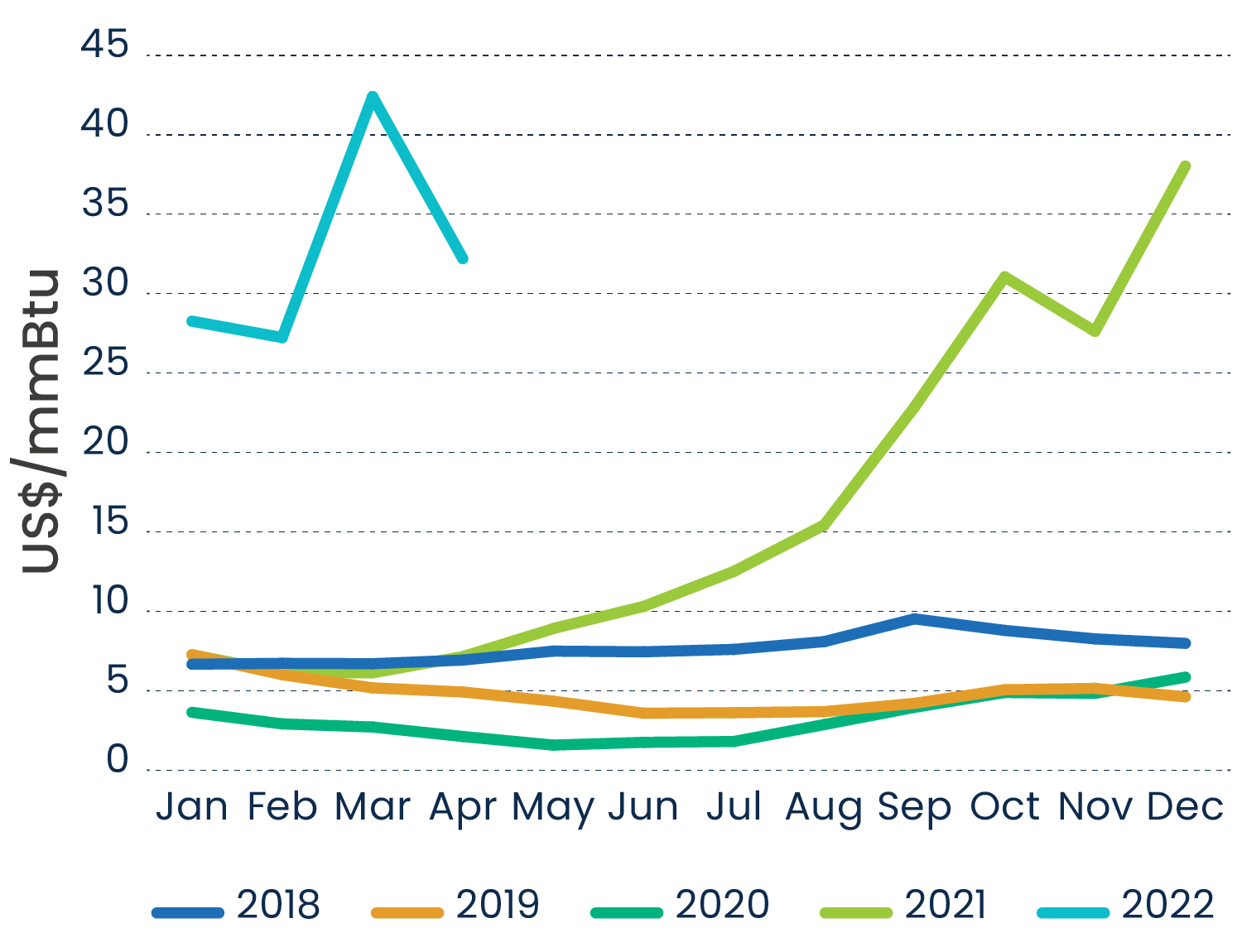

Since September 2021, Europe has been grappling with exceptionally high energy prices. With record high prices and gas moving up to 90% of the variable costs in fertilizer production, the situation has become economically stressed for the fertilizer sector in Europe.

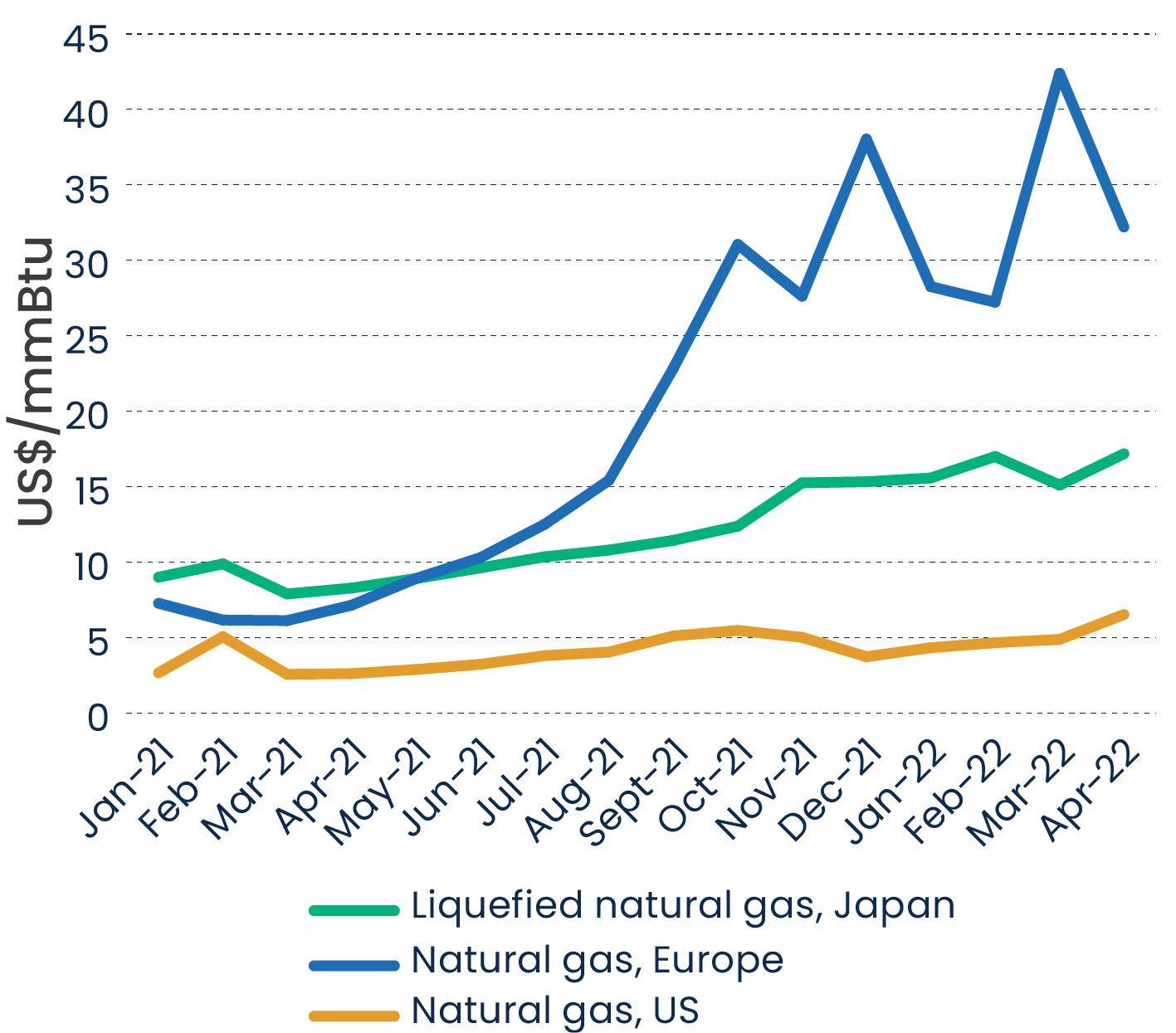

In early March 2022, the EU's monthly average gas price peaked at US$42 MMBtu on the TTF exchange. The long-term average since 2005 to date has been around US$8 MMBtu.

Spot gas prices in Europe (TTF)

Source: The World Bank Data (in US$/mmBtu)

Source: The World Bank Data (in US$/mmBtu)

The unprecedented high gas prices in Europe have made production of ammonia and fertilizers at times unviable. Several fertilizer producers across Europe have either announced short-term closures or temporary curtailment of ammonia and fertilizer production.

Meanwhile, most non-EU producing countries have been benefiting from access to artificially low, state-fixed priced gas and thus have been profiteering from the artificial gas price gap.

Spot gas prices in the EU, US, Japan

As an immediate response, Fertilizers Europe ran in October 2020 an all-out advocacy and media campaign to raise awareness about the gravity of the situation in the fertilizer industry. It called for EU and Member States authorities to take urgent corrective action as well as to address the challenges on the European energy market.

The association reached out to the top EU officials, including the EU Commission President von der Leyen, the Council President Michel, the Slovenian Presidency as well as the Commissioner Simson responsible for the energy portfolio. A public awareness campaign was launched in October through main Brussels media. Fertilizers Europe digital channels were used to extend the outreach and underline the urgency to act.